BUDGET SEASON: A Deep Dive into Dilley’s 2017-18 Budget Proposal

Next week, the Dilley city council will vote on whether or not raise the local property tax rate to $0.885281, a 10% increase from the current $0.802301 property tax rate.

The tax decision will rest largely on the demands of the proposed budget released by the city last month (available here). For the sake of comparison and scrutiny, this article uses the new total 2017 taxable value for the city of Dilley and calculates projections based on the current 2016 property tax and collection rate…

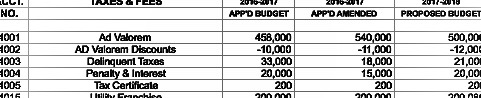

YEAR-TO-YEAR AD VALOREM (PROPERTY TAX) REVENUE

2016 total taxable appraisal in Dilley: $165,722,920

2016 property tax rate: $0.802301

2016 property tax revenue, if 100% of taxes are collected: $1,329,597

Collected to date (9/19/17): 94.07%

Total collected for 2016 to date: $1,250,752

Approved amended collection rate for 2016-17 in budget document: 96%

2017 total taxable appraisal: $157,784,720

2017 proposed tax: $0.885281

2017 property tax revenue, if 100% of taxes are collected at proposed rate: $1,396,838

2017 property tax revenue, if 94.07% of taxes are collected at proposed rate: $1,314,006

2017 property tax revenue, if 94.07% of taxes are collected at 2016 rate: $1,236,085

Notes: At the current 94.07% collection rate, the city of Dilley would generate $63,254 more in ad valorem revenue at the higher proposed tax rate, even though the total taxable property value is lower.

If the property tax stays at the 2016 rate, the city of Dilley would generate $14,667 less in the approaching fiscal year because the total taxable appraisal is lower.

YEAR-TO-YEAR GENERAL FUND EXPENSES

2016-17 Amended General Fund Expenses: $2,180,790

2017-18 Proposed General Fund Expenses: $2,169,680

Notes: The city of Dilley projects a savings of $11,110 in expenses for the new fiscal year.

2017-18 GENERAL FUND VS. DEBT SERVICE

The total ad valorem revenue is divided between the general fund and the debt service fund.

Proposed ad valorem rate for general fund (Maintenance & Operations): $0.393755

Proposed ad valorem rate for debt service fund (Interest & Sinking): $0.491526

These figures add up to the aforementioned total ad valorem: $.885281

Total general fund revenue projected in city’s budget document:

$500,000

However, here are some revenue calculations based on the $157,784,720 figure from the 2017 certified tax appraisal roll and a few other variables:

Total general fund revenue at proposed tax rate and 94.07% collection: $584,309

Total general fund revenue at current tax rate and 94.07% collection: $499,334

Total general fund revenue at proposed tax rate and 90% collection: $559,187

Total general fund revenue at current tax rate and 90% collection: $477,730

Total debt service revenue projected in city’s budget document: $735,000

Total debt service revenue at proposed tax rate and 94.07% collection: $729,562

Total debt service revenue at current tax rate and 94.07% collection: $691,505

Notes: The city’s budget proposal document shows $500,000 for this general fund revenue line item, instead of $584,000 based on the proposed tax rate. This $84,000 is 17% more than the city’s general fund ad valorem projected revenue. Even at a conservative 90% collection rate, the revenue would be $559,157. City Manager Rudy Alvarez, recently hired after the budget process began, had already noted the same discrepancy in projections when asked.

Debt obligations account for 56% of the proposed property tax rate. The city currently has borrowed approximately 9 million dollars in certificates of obligation since 2011 for streets, water and sewer, and the convention center/city hall/library.

2017-18 TOTAL GENERAL FUND REVENUES VS. EXPENSES

Total general fund revenue is a combination of a portion of ad valorem plus other city revenues such as permits, muncipal court, etc.

City total general fund revenue projected by city budget: $2,201,880

However, here are some revenue calculations based on the $157,784,720 figure from the 2017 certified tax appraisal roll and a few other variables:

City general fund revenue at proposed property tax rate and 94.07% collection: $2,286,189

City general fund revenue at current property tax rate and 94.07% collection: $2,201,214

City general fund revenue at current property tax rate and 90% collection: $2,179,610

City total general fund expenses in budget document: $2,169,680

Notes: Using last year’s property tax rate and a conservative 90% collection rate, the city’s general fund would generate $10,000 more than expenses in the 2017-18 fiscal year.

According to last year’s amended budget, the city expected to generate $60 more in general fund revenue than expenses for the 2016-17 fiscal year.

THE CONVENTION CENTER

According to the budget document, projected revenue from the $4 million dollar convention center is $5,500 for the 2017-18 fiscal year. Annual convention center utility and maintenance expenses were not separated out by the budget, but can be expected to exceed $5,500.

The city expects to rent the convention center for $800 per day. Thus, by the city’s projections, the convention center will be rented out for 7 days in the 2017-18 fiscal year.

–written by Jose Asuncion.

Jose received an MFA from University of Southern California in 2008, a BA from the University of Illinois at Chicago in 2003, and currently lives in Dilley, TX, home of his grandparents.