On Monday October 10th, Dilley voted to adopt a property tax rate of $.802301 per $100 on approximately $158 million dollars of appraised property tax value. For the past year, however, city attorney Bobby Maldonado has argued that the total appraised value should be far higher due to an alleged $60 million dollar under-valuation of CoreCivic’s South Texas Family Residential Center.

A story in three council meetings…

PART I – August 2016

FIRST SIGNS

For the 2015 tax year, the City of Dilley expected a boon in property tax revenue after the arrival of Corrections Corporation of America’s new South Texas Family Residential Center, the nation’s largest detention facility for immigrant mothers and children. Construction was scheduled to be complete by July 2015, so most of the value should have been reflected in the Frio County Appraisal District’s valuation of the property.

According to the city, CCA had requested and received a $102 million dollar permit to build the STFRC facility, which would represent nearly half of all property value in Dilley and roughly $800,000 in revenue for the city alone. And by the end of November 2015, most of the property tax bills were paid.

But the city of Dilley must have thought something was wrong. The January 23, 2016 line item from city attorney Bobby Maldonado’s invoice reads: “Review of CCA MOU file regarding property tax rendition compliance,” referring to the memorandum of understanding signed by CCA and the City of Dilley.

That year, the STFRC property value was appraised closer to $40 million than $100 million, resulting in far lower city revenue than projected. In the meantime, Dilley was about to break ground on a new $4 million dollar convention center; property, sales, and hotel occupancy tax revenues were plummeting due to the 2014 oil bust; and warnings and potential fines were piling up from the Texas Commission on Environmental Quality.

What follows is the story of a small town city council that approved a deal they didn’t fully understand, entering an agreement while legally outgunned by a multi-billion dollar corporation.

APPRAISAL PROCESS

Luciano Gonzales, Chief Appraiser of the Frio County Appraisal District, sits in his wood-paneled office. His desk and walls are piled with papers that were once placed in sight for easy access, then covered with more and more papers, also for easy access.

Each year, Gonzales’ office is responsible for producing appraisals for each property in the county. Each taxing entity then collects taxes based on those appraisals. For a Dilley property owner, tax payments include City of Dilley, The Dilley Independent School District, and Frio County, among others, who each set their own independent tax rates based on their respective budgets.

Before the property owners pay their bill, however, they have the right to protest the appraised value of their property. They may argue that the appraised value is too high, hoping to lower the estimated value of their property and thus have a lower tax bill.

In the case of the South Texas Family Residential Center, it is not the property owner protesting the tax district’s appraisal. It’s the taxing entity, the City of Dilley, saying that the appraisal should be far higher, and the potentially low valuation is robbing all relevant taxing entities of revenue.

Gonzales’ advice for a taxing unit that has a problem with an appraisal? He gestures to a copy of the Texas Property Tax Code manual on his desk.

AUGUST 9, 2016 DILLEY CITY COUNCIL MEETING

On August 9 City Attorney Bobby Maldonado addressed Dilley’s city council. “What we’re asking is to direct city staff and my office to be able to work with not only CCA but also the Appraisal District and others with respect to finding out exactly what CCA should be paying in property taxes,” he said.

Why, exactly, did the city attorney believe that valuation of the South Texas Family Residential Center should be higher?

“What we do know is that they pulled a permit for a considerable amount of money and they rendered tax value at considerably less. And the Appraisal District came back with a tax value at much less than what the permit was pulled at.”

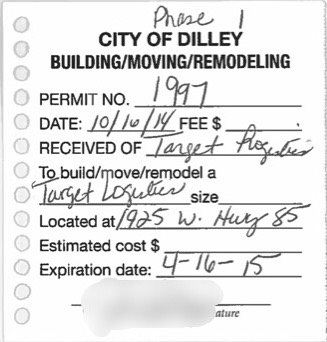

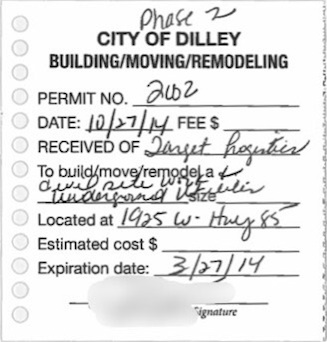

Below is a screenshot of the building permits in question:

There’s an argument to be made that Dilley should have updated the permit process that generated the document at the core of their legal dispute before doing business with a publicly traded, multi-billion dollar corporation. The permits for the $100 million dollar detention center project are slightly larger than post-it notes, with incomplete handwritten information. Some of the missing information? The estimated cost.

In an email, the city advised that “the permit was issued in two phases, construction cost was $102,073,393,86.” However, there are no applications on file for these permits. According to the city, the application is not available- not in Dilley’s records, nor with LNV, the city’s contracted engineer.

“If you give us this authority,” Maldonado said in the meeting, “then we can certainly try to reach out to the Appraisal District, to try and figure out the best way to get out there and get the appraisal done, as quickly as possible.” A new appraisal, he hoped, would bridge the distance from $40 to $100 million before the next fiscal year.

The motion was made “to authorize all city staff and city attorney to take all necessary action regarding the CCA tax appraisal matters.” The motion passed unanimously, though Mayor Pro-Tem Ray Aranda was absent for this meeting. As a member of the Frio County Appraisal District board of directors, it would be his job to bring this up at their next meeting…

To be continued… Part II

–written by Jose Asuncion.

Jose received an MFA from University of Southern California in 2008, a BA from the University of Illinois at Chicago in 2003, and currently lives in Dilley, TX, home of his grandparents.